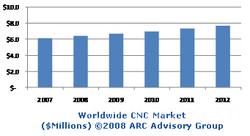

August 12, 2008: The Computer Numerical Controls (CNC) market has simply exploded in the last two years lead by the surge in production of machine tools in the European and Asian markets. The worldwide market for CNC systems is expected to grow at a compounded annual growth rate (CAGR) of 4.8% over the next five years. The market was $6.1 billion in 2007 and is forecasted to be over $7.7 billion in 2012, according to a new ARC Advisory Group study.

August 12, 2008: The Computer Numerical Controls (CNC) market has simply exploded in the last two years lead by the surge in production of machine tools in the European and Asian markets. The worldwide market for CNC systems is expected to grow at a compounded annual growth rate (CAGR) of 4.8% over the next five years. The market was $6.1 billion in 2007 and is forecasted to be over $7.7 billion in 2012, according to a new ARC Advisory Group study. “The demand for CNC solutions benefited from the robust investments in general manufacturing, oil & gas infrastructure, automotive, aerospace, green energy, and infrastructure industries. We continue to expect a strong positive growth in the CNC market, at least to the end of 2008, however the expansion in the market will begin to abate as the growing concern over global energy prices and unstable financial markets begins to have an impact on investments,” according to Director of Research Sal Spada (sspada@), the principal author of ARC’s “Computer Numerical Controls Worldwide Market Outlook.”

Competitive Climate Remains Unchanged

The CNC market remains highly consolidated with nearly two-thirds of the market being dominated by FANUC and Siemens. Competition among the top three suppliers is aggressive, as the developing Asian market ramps up. The issue at stake is installed base; the demand side in this market very rarely switches suppliers due to the investment in personnel training and the ability to move applications from one machine to the next.

Emerging Markets Sustain Growth

Currently, the market is more than halfway through the cycle which experienced its last low point in 2002. The troughs of this cycle tend to be extremely low while the peaks increase slightly from crest to crest. Emerging economies, such as Russia, India, and China, and Eastern Europe, will continue to propel the overall market growth with an unprecedented number of relatively low valued machine tools built in these regions.

Growing Middle Class Drives Demand

The increasing consumer demand from the growing middle class, adding new infrastructure to become a part of the global community, and the need for producing and saving energy to cope with the rapidly rising global energy demands and costs are driving the demand for CNC-based machine tools.

About ARC: Founded in 1986, ARC Advisory Group has grown to become the Thought Leader in Manufacturing and Supply Chain solutions. No matter how complex your business issues, our analysts have the expert industry knowledge and first-hand experience to help you find the best answer. We focus on simple yet critical goals: improving your return on assets, operational performance, total cost of ownership, project time-to-benefit, and shareholder value.

(转载)